Extensive knowledge of the UK media is essential for any Digital PR who prides themselves on sending relevant, targeted outreach emails to journalists. It’s easy to target journalists in various generalised verticals; however, Digital PR best practice is more time-intensive and detailed than that. It’s advisable to learn as much as possible about the UK journalists you’re pitching to, sure, but you’re missing a trick if you don’t also know the audience of the newspapers, magazines and editorial sites the journalists we work with, work for. Understanding the UK news media will help you make better choices on where to pitch and should help you visualise where the campaign can be pitched, even as early as in the ideation stage of the Digital PR campaign process.

As a journalist in America, I was really familiar with how the US news media worked. Then, when I moved to the UK in 2013 as a PR professional, I found myself confused by the entire industry. So, I made it my mission to learn as much as possible.

It recently occurred to me that an overview of the UK news media – a sort of Media Studies GCSE for professionals – could be helpful for people new to Digital PR, but also to my fellow Digital PRs who are not UK natives.

Enjoy reading the report and feel free to download the PDF and share. The more we know about the UK news media and how it works the better we’ll be at our jobs in Digital PR.

– Amie Sparrow

An Overview of the UK News Media

Traditionally, the UK news media landscape has been a relatively simple one. There are broadsheet newspapers such as The Times and The Guardian — named so because of the size and shape of the paper used for printing — and there are tabloid papers such as The Sun and The Mirror — smaller, more manageable, easier to read.

The two categories were largely aimed at specific economic demographics. In a very general sense, broadsheets were targeted towards readers in lower middle class and upper middle class brackets, while tabloids found their readership within the working-class end of the spectrum.

Within these categories, there were certain political affiliations. Both the broadsheet Guardian and the tabloid Mirror have traditionally been left-wing papers, geared towards supporters of the Labour Party, while the Times and the Sun — at least since the election of Margaret Thatcher in 1979 — have been right-leaning, Conservative papers. But the digital age has added dynamism to the media landscape. Customers no longer buy ‘the paper’ each morning, entering the carefully curated media funnel of one particular outlet. Instead, they have unprecedented choice, with stories from a range of different outlets delivered to them via social media, news aggregation apps, digital subscriptions, and a number of other online channels. So where does this leave us now? How has this impacted the news media landscape?

Understanding Economic Demographic Brackets

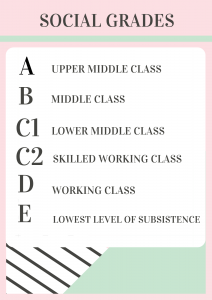

Before we continue into a more in-depth analysis of the UK’s media market, we first need to understand the economic demographic brackets these publications serve. The Office for National Statistics applies an Approximated Social Grade to the UK’s population, based upon the economic resources of individuals surveyed in the UK census. The six social grades are:

-

- A: Upper middle class individuals — the highest level of economic resources across UK society

- B: Middle class individuals

- C1: Lower middle class individuals

- C2: Skilled working class individuals

- D: Working class individuals

- E: Individuals at the “lowest level of subsistence”

Typically, broadsheets are targeted at individuals in the A and B brackets, while tabloids are aimed at those in the D and E tiers. Individuals across C1 and C2 may be targeted by both broadsheet and tabloid publishers. We can apply the broader classifications ABC1 and C2DE to denote the upper and lower portions of this structure.

UK News Publishers

News UK

News UK is the British arm of the American group News Corp, owned and operated by media moguls Rupert and James Murdoch. News UK provides titles such as The Times, The Sunday Times, The Sun, and The Sun on Sunday to the UK market.

-

- The Sun enjoys a monthly readership of 28.191 million as of 2021, but only 6.388 million of these readers access the print version. Of the 24.7 million digital readers, 23.052 are accessing content on phone or tablet. The Sun traditionally sits within the C2DE market.

-

- The Times is read by 15.791 million readers each month, spread across 4.102 million print readers and 13.164 digital — 12.326 million of whom read on a phone or tablet device. The Times is generally considered an ABC1 paper.

Reach PLC

Reach PLC was formerly known as Trinity Mirror and is responsible for the Daily Mirror and the Sunday Mirror. Other national titles include Sunday People, Daily Express, Daily Star, and Daily Star Sunday. Reach also provides many of the UK’s regional coverage, including well-established brands such as the Manchester Evening News and the Bristol Post.

-

- The Daily Mirror was accessed by 25.743 million readers a month in 2021, only 3.382 million of whom accessed print copies. 22.118 million of 23.866 million digital readers accessed content on phone or tablet devices. The Mirror is targeted to the C2DE market.

-

- The Daily Express — like the Mail, positioned somewhere between the tabloids and the broadsheets — was read by 18.437 million per month in 2021, with roughly 10% (1.841 million) accessing the print copy. 15.256 million of the 17.258 million digital readers used a phone or tablet device. The Daily Express may be positioned within the C1C2 market, but the paper also targets individuals from other income tiers.

-

- The tabloid Daily Star newspaper achieved a monthly readership of 12.622 million in 2021, with only 1.358 million of these accessing the print copy. Of the 11.662 million digital readers, almost all (11.070 million) accessed mobile and tablet copies. The Daily Star is aimed at the C2DE market.

-

- Regional newspapers such as Manchester Evening News (MEN) have seen print readership figures fall sharply. MEN print circulation fell by 46% year-on-year in the second half of 2020, falling 16,785 per day on average. This climbed to almost 21,000 in the second half of 2021. Regional newspapers generally exist outside of the ABC1 or C2DE classifications, but they are geared more towards C2DE readers.

Daily Mail Group

The Daily Mail Group’s flagship papers are the Daily Mail and the Mail on Sunday, positioned somewhere between the traditional broadsheet and tabloid markets. The Group also provides the free Metro paper, and i, the descendant of The Independent newspaper.

-

- The Daily Mail was read by 26.062 million people each month in 2021, with 6.304 million print readers. 19.969 million of 22.430 million digital readers read on mobile or tablet devices. Like the Express, the Daily Mail is positioned within the C1C2 market, but it targets readers outside of this band.

-

- The Metro is delivered for free on transport networks across the country, but this contributed to only 5.937 million monthly print readers in 2021, out of 21.183 million in total. 15.930 million out of 17.332 million digital readers accessed the Metro on smartphones and tablets. The Metro is a free paper and exists outside of the economic social tier structure, although the style and presentation mirrors tabloid papers in the C2DE group.

-

- i achieved 8.978 million monthly readers in 2021, consisting of 8.049 million digital readers and 1.239 million in print. 6.973 million accessed the paper on phone or tablet devices. The Independent was a broadsheet, aimed largely at the ABC1 market, although the tabloid-influenced presentation of it has expanded its market beyond this boundary.

Guardian Media Group

The Guardian Media Group provides the longstanding Guardian newspaper — originally the Manchester Guardian — and The Observer.

-

- The Guardian was read by 19.793 million people each month in 2021, broken down into 3.187 million print readers and 18.422 digital readers. 15.709 million of these digital readers accessed the paper via mobile and smartphone. The Guardian positions itself politically to the left of other broadsheets, taking a social democratic tone on most issues, but the paper is still largely aimed at ABC1 readers.

-

- GMG’s weekly paper, The Observer, does not have digital services and delivered 550,000 print copies per month in 2021. The Observer is a broadsheet in the ABC1 category.

Telegraph

The Telegraph Media Group is another of the most influential figures on the UK’s news media scene, providing The Daily Telegraph and Sunday Telegraph to the market.

-

- The broadsheet Daily Telegraph edges out its rival The Times with 16.067 million monthly readers in 2021, 14.372 million of whom accessed digital copies, while 2.736 million read print copies. Mobile and tablet readership was also a little greater than that of The Times, at 12.820 million. The Daily Telegraph is an ABC1 paper.

Significant Changes in the News Publishing Sphere

Looking at the data above, we can see immediately that UK consumers prefer to access their news digitally and are turning their backs on traditional sources of information — i.e., a newspaper purchased or delivered to the home each day or each week. Free papers like the Metro and regional publishers such as the Manchester Evening News operate different distribution models, and we might expect these publishers to be anomalous outliers. However, again the data shows us this is not the case — digital services are far more popular for these publishers, too.

Is this the result of the digital age? Not necessarily. Since 1950, the circulation of paid Sunday and daily newspapers has been falling steadily. While daily newspaper sales rallied slightly through the 1980s, this was only temporary, and both sets of circulation figures are now only fractions of what they were 70 years ago. It’s also important to note that there were fewer than 15 million households in the UK in 1950. By 2010, there were more than 25 million. So circulation figures have been falling even while potential readership pools grow.

This casts a different light upon the print v. digital figures listed above. If circulation figures have been falling for almost three-quarters of a century, then we cannot blame the convenience and ease of digital media for “killing” the newspaper industry. Instead, digital services are actively saving publishers, providing them with a reliable revenue stream as traditional print markets dwindle.

UK Magazine Publishers

Specific and General Interest Magazines

-

- Car magazines such as the well-established Top Gear (1,254 total reach, 701 digital) and Auto Express (1,836 total, 1,579 digital) continue to be popular but are becoming dominated by their digital reader base.

-

- Fitness and lifestyle publications — including those for men, for women, or gender-neutral — such as Men’s Health (2,484 total reach, 2,020 digital) and Runner’s World (927 total, 795 digital) are similarly dominated by digital copies.

-

- Other magazines such as Conde Nast Traveller (1,437 total, 1,323 digital) and British GQ (1,124 total, 941 digital) are also aimed predominantly at digital readers.

-

- A small number of magazines have retained a relatively strong print showing. BBC History, for example, has an almost even split of print and digital readers (329 to 330), while the Big Issue — operated on a social business model and distributed largely by homeless individuals — remains a predominately print-based publication (762 of its 951 total reach comes from the print edition).

Women’s Magazines

-

- Hello! and OK magazines lead the way in the weekly stakes, with a monthly reach of 10,977 (10,005 digital) and 7,433 (6,263 digital), respectively. Their closest competitors all fall below 2,500.

-

- Grazia is at the forefront of the fortnightly magazine market, with 1,262 (871 digital), compared to Yours Magazine’s 790. Yours still achieves the majority of its brand reach from its 413 print copies.

-

- BBC Good Food is top of the table among women’s monthlies, with a reach of 10,665 (10,068 digital). Cosmopolitan sits in second with a reach of 5,073 (4,541 digital).

Print-Only Magazines

-

- Supermarket giant Tesco provides one of the leading print-only magazines to the market, with a monthly print reach of 5,529 for Tesco Magazine. High-end supermarket Waitrose is also among the market leaders with Waitrose Food at 2,656 per month.

-

- The National Trust and English Heritage organisations maintain cultural and historical sites through the UK, and both provide print-only publications to subscribers and donors. National Trust achieves a monthly reach of 2,224 to English Heritage’s 501, although the publications are only released each quarter.

-

- The majority of print-only magazines struggle to achieve a monthly reach of more than 500, with most falling far below this. Even weekly magazines such as Best and New achieve on 436 and 257 respectively.

The Rapid Decline of Print Magazines

The print magazine readership is decreasing even more rapidly than that of print newspapers. In 2011, 820.1 million copies of print magazines were sold in the United Kingdom. By 2018, this had more than halved, falling to 373.8 million. This, of course, has a huge impact on revenue. The print magazine market’s 2011 revenue was £1.172 billion — falling to £634.2 million only seven years later.

Again, digital services are powering and supporting magazine publishers rather than strangulating them. The cost and inconvenience of traditional regular print publication is driving readers online, seeking content in new and more engaging ways. Magazine publishers, like their newspaper counterparts, need to reflect these trends in their audience offerings, hence the dramatic increase in online and digital publications.

Understanding the Shift Away from Print

So, what is actually happening here? Why is digital media now the dominant force in news and magazine publishing? There are a number of factors that influence this shift.

The ubiquity of smartphone devices

By 2025, it is estimated that 94% of the UK population will own a smartphone. This means that the vast majority of UK residents have a powerful device for consuming news and media right in their pocket. Basically, the distribution hardware is already in place.

The rapid pace of news

In 1997, the BBC launched News 24, since rebranded to BBC News, or the BBC News Channel. This represented the first time a terrestrial television broadcaster had launched a 24-hour digital news channel, and reflected the need for round-the-clock news coverage. This need is also found in the newspaper publishing industry — the public wants regular updates on breaking news, not a daily overview.

The desire for broader insight

In December 2021, there were 669.1 million visits to BBC news websites, while DailyMail.co.uk and TheGuardian.com received 155.8 million and 125.1 million hits, respectively. These are big numbers and suggest that UK news consumers are accessing multiple publisher websites as part of their daily browsing habits. If this is the case, purchasing a single newspaper is not going to provide the coverage these consumers need.

The rise of social media

Many of us have clicked on news website links, shared by friends across social media. Many of us have also shared these links ourselves. This is leading to a more fluid and dynamic approach to the news, as readers receive links from a variety of publishers, across a variety of channels.

The suitability of the online sphere

The online landscape lends itself perfectly to news and magazine publishing. Users can browse casually and check out stories they like, or they can spend time reading specialised articles — they can also interact with content, watching videos, adding comments, hitting share buttons and carrying out all manner of other functions. None of this is possible with the traditional newspaper experience of sitting down and reading a paper cover to cover.

Increasing Dynamism in the Future

Digital publications now dominate the UK media landscape, and mobile devices such as smartphones and tablets have become the primary points of access for British media consumers. The result of this is reduced overheads and costs for publishers as they turn their backs on expensive print operations, as well as an increasingly competitive market for news publishers themselves and advertisers and other stakeholders.

The rise of digital media in newspaper and magazine publishing shows no sign of slowing down, and we can expect this shift to continue in the coming years. It’s important to remember, however, that moves away from print are not damaging the publishing industry — instead, they are supporting its adaptation and evolution in a changing market.